FAQ: Understanding The Employee Retention Tax Credit (ERTC)

Explores the most frequently asked questions about Employee Retention Tax Credit. Using professional accountants, ensure compliant filings and their ability to provide support during audits.

Harnessing The Power Of Professional Accountancy For Your Employee Retention Tax Credit Claim

The role of a professional in filing Employee Retention Tax Credit (ERTC) to navigate tax laws and IRS regulations, nsure accurate filings, safeguard against audits. Tips on selecting accountant.

Debunking Common Misconceptions Around The Employee Retention Tax Credit

Clear up misconceptions, learn the facts about the Employee Retention Tax Credit. Get an in-depth understanding to make an informed decision about filing for ERTC.

Navigating the Employee Retention Tax Credit Landscape: A Guide to Avoiding Scams

Scams targeting the Employee Retention Tax Credit (ERTC) are on the rise. Learn how to mitigate risk and ensure a worry-free ERTC filing with our comprehensive guide.

Boost Your Business's Bottom Line The Employee Retention Tax Credit (ERTC): A Lifeline for Small Businesses in Challenging Times

Employee Retention Tax Credit info. Discover essential facts, understand broad eligibility criteria, maximize your refund. How to hire a qualified professional and avoid scams.

Understanding The Employee Retention Tax Credit: More Than Just Financial Relief

Discover how the Employee Retention Tax Credit (ERTC) is more than just financial relief - it's a strategic tool that can fortify your business, bolster your workforce and boost future growth.

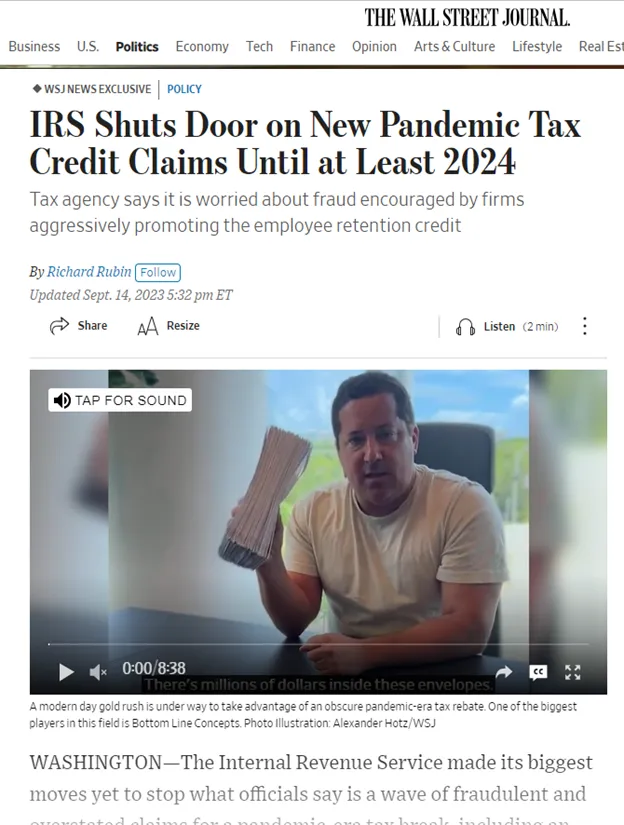

Breaking News: IRS Puts Pause On Processing Employee Retention Tax Credit Claims

IRS pauses processing Employee Retention Tax Credit claims until 2024. Here what the founder of the largest ERTC firm has to say about the scandal.